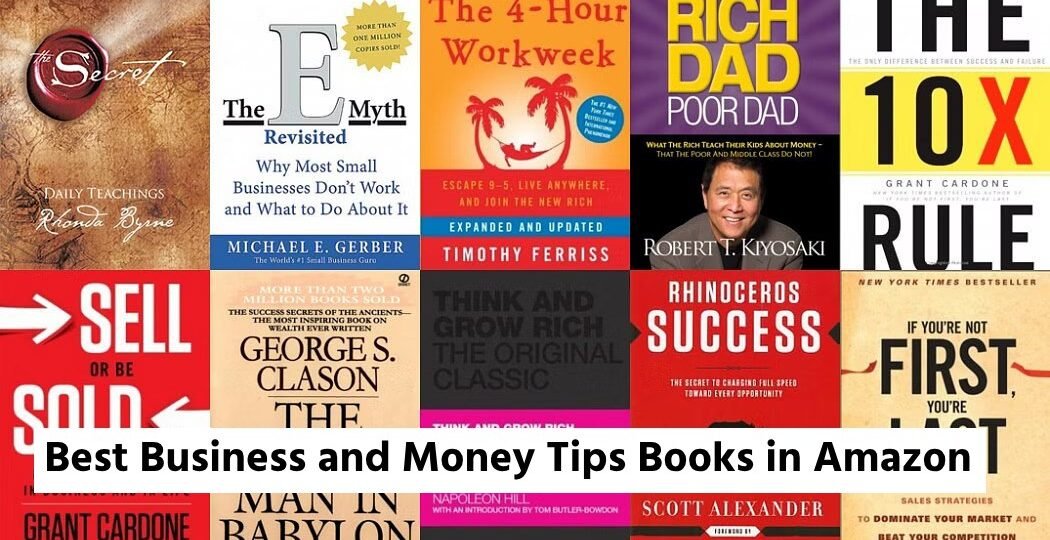

Buying Best Business and Money Tips Books in Amazon, business, and money-related books can be a valuable investment in your personal and financial growth. These books help you understand how money works, how to manage it wisely, and how to build wealth over time. For example, books like Rich Dad Poor Dad or The Psychology of Money can shift your mindset and teach you the difference between assets and liabilities. If you’re interested in starting or improving a business, titles like The Lean Startup provide practical strategies for innovation and entrepreneurship. Books like Atomic Habits are great for building discipline and better daily habits, which can improve not just your finances but also your overall productivity. Others, such as The Total Money Makeover or I Will Teach You to Be Rich, offer step-by-step guides on getting out of debt, budgeting effectively, and investing for the future. By reading these books, you’re not just gaining knowledge—you’re setting yourself up for smarter decisions, better opportunities, and long-term financial stability. In short, buying these books means investing in yourself.

1. Think and Grow Rich Best Business and Money Tips Book

Best Business and Money Tips Books in Amazon Think and Grow Rich is a timeless self-help classic originally written by Napoleon Hill in 1937, now revised and updated to reflect modern examples and language while preserving its core message. The book is based on Hill’s 25-year study of some of the most successful individuals of his time—such as Andrew Carnegie, Henry Ford, and Thomas Edison—and outlines 13 principles for achieving personal and financial success. At its core, the book emphasizes the power of focused thought, belief, and persistence. It teaches that success begins with a burning desire, a definite purpose, and a plan backed by unwavering faith and action. This updated edition, with input from Arthur R. Pell, includes examples from contemporary entrepreneurs and business leaders, making the ideas more relatable for today’s readers. More than just a guide to making money, Think and Grow Rich is a philosophy of mindset, self-discipline, and resilience, inspiring millions to believe in their ability to shape their own destiny.

2. The Psychology of Money Business and Money Tips Books

The Psychology of Money by Morgan Housel offers a fresh and deeply human perspective on how people think about and manage money. Instead of focusing on technical financial advice or investment strategies, Housel explores the emotional and psychological factors that drive our financial decisions—Business and Money Tips Books often irrationally. Through 19 short, insightful chapters, he illustrates how behavior, not intelligence or income, plays the most crucial role in building and maintaining wealth. Drawing from history, personal stories, and behavioral economics, Housel explains why people with vastly different experiences handle money so differently—and why luck, patience, and humility matter more than we think. He emphasizes timeless truths such as the power of compounding, the value of living below your means, and the importance of defining what “enough” means to you. Thought-provoking and highly readable, The Psychology of Money is less about getting rich and more about achieving financial peace of mind through understanding yourself.

3. The Total Money Makeover Business and Money Tips Books

Business and Money Tips Books The Total Money Makeover by Dave Ramsey is a no-nonsense, step-by-step guide to taking control of your finances and building lasting wealth, now updated and expanded for 2024. Known for his tough-love financial advice and practical strategies, Ramsey lays out a proven plan that focuses on eliminating debt, building emergency savings, and investing for the future—without gimmicks or get-rich-quick schemes. This updated edition includes new real-life success stories, updated statistics, and refreshed tools to reflect today’s economy and challenges. At the heart of the book is Ramsey’s “Seven Baby Steps,” which begin with creating a $1,000 emergency fund and end with building wealth and giving generously. With a focus on discipline, budgeting, and long-term thinking, The Total Money Makeover is especially useful for those struggling with debt or living paycheck to paycheck. Whether you’re starting from scratch or want to fine-tune your financial habits, this book offers a clear, motivating path toward financial peace and independence.

4. Transform Your Business from a Cash

Profit First flips the traditional accounting formula—Sales – Expenses = Profit—on its head and replaces it with a simpler, more powerful principle: Sales – Profit = Expenses. In this eye-opening book, entrepreneur and author Mike Michalowicz argues that most small business owners prioritize growth and operations at the Business and Money Tips Books expense of actual profitability. He presents a practical system that ensures you take your profit first—literally—by allocating a percentage of income to profit before paying operating expenses. The book outlines how to set up separate bank accounts for different business functions (like profit, taxes, owner’s pay, and operating expenses), creating automatic financial discipline. Through real-world examples, simple language, and a touch of humor, Michalowicz demonstrates how businesses of all sizes can become consistently profitable without needing complicated spreadsheets or financial expertise. Profit First is ideal for entrepreneurs, freelancers, and small business owners who feel constantly cash-strapped despite healthy sales—and want a smarter, sustainable way to manage money.

5. The Millionaire Next Door

The Millionaire Next Door reveals the unexpected truths about wealth in America, based on extensive research by authors Thomas Stanley and William Danko. Unlike the media-driven image of flashy millionaires living in luxury, this book uncovers a different reality: most U.S. millionaires live modestly, budget carefully, and prioritize financial independence over status. Through detailed data and case studies, the authors identify key habits of the wealthy—such as living below their means, investing consistently, avoiding debt, and making thoughtful financial choices over time. The audiobook, narrated by Cotter Smith, brings these insights to life in a clear and engaging voice, making the research easy to follow and applicable. The book challenges the idea that high income equals wealth, and instead shows that discipline, planning, and long-term thinking are the real secrets. Whether you’re just starting out or trying to shift your financial mindset, The Millionaire Next Door offers timeless advice for building lasting wealth quietly and effectively Business and Money Tips Books.

Business and Money Tips BooksThe Millionaire Next Door reveals the unexpected truths about wealth in America, based on extensive research by authors Thomas Stanley and William Danko. Unlike the media-driven image of flashy millionaires living in luxury, this book uncovers a different reality: most U.S. millionaires live modestly, budget carefully, and prioritize financial independence over status. Through detailed data and case studies, the authors identify key habits of the wealthy—such as living below their means, investing consistently, avoiding debt, and making thoughtful financial choices over time. The audiobook, narrated by Cotter Smith, brings these insights to life in a clear and engaging voice, making the research easy to follow and applicable. The book challenges the idea that high income equals wealth, and instead shows that discipline, planning, and long-term thinking are the real secrets. Whether you’re just starting out or trying to shift your financial mindset, The Millionaire Next Door offers timeless advice for building lasting wealth quietly and effectively.